The Ultimate Guide To Cape Coral Mortgage Company

Table of ContentsLittle Known Questions About Cape Coral Mortgage Brokers.Some Known Details About Cape Coral Mortgage Company The 10-Second Trick For Cape Coral Mortgage BrokersThe 6-Minute Rule for Mortgage Broker Cape Coral

That is why the borrower ought to be prepared to offer the lender the complying with details: Bank information such as the name, address, account numbers, as well as three months of statements. 3 months of investment statements. W-2s, pay stubs, evidence of employment and two years worth of earnings. Income tax return as well as equilibrium sheets for the independent.Separation documents, if they use. As soon as the application is completed, the loan provider will review the application and determine whether to refute or accept it. If authorized, the last action in the procedure is the meeting in which documents is finished and the offer is shut. If denied, the potential borrower needs to talk with the loan provider in order to devise a plan as well as learn why the application was refuted.

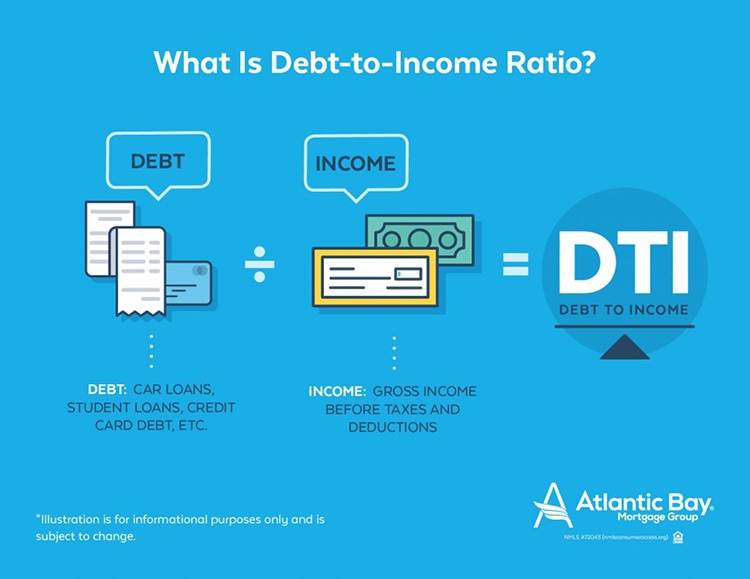

The ability to pay is one of the main choices in taking into consideration a finance application for authorization. All info regarding income and work history must be sent. This information includes: Employer's name, address, consumer's task title, time at work, incentives, typical overtime, income, and trainees may be required to provide records.

For the independent, monetary statements for 2 years as well as all tax kinds need to be provided, including an earnings and loss declaration for the current year. If there are voids in work history, there must be a composed description. A VOE or Verification of Employment kind may be sent to the current company.

All celebrations authorize the required papers and officially seal the bargain. Ownership of residential or commercial property is transferred to the customer, so the closing date creates a great possibility to make any essential adjustments in the nick of time. These treatments differ from state-to-state, yet in a lot of states the following people are present at the closing: A shutting agent that might function for the lender.

The 7-Minute Rule for Cape Coral Mortgage Company

Below is a summary of those records: The one offering the home must bring the act with them to the closing. It has to be signed and sworn so that the lender can have the deed submitted at the area's Act Registrar because it is public document. The HUD-1 Negotiation statement makes a list of the services by the lender that relates to the lending and charges both the vendor as well as the customer.

The home loan note have to be authorized since it is the purchaser's debenture according to the terms. These products include repayment due days, quantities, as well as where the payments need to be remitted to. The declaration that provides the real interest rate, APR, fees, and various other prices is the Truth-In-Lending Declaration.

Home owners with a stable payment background might gain from current price volatility. Are you still paying way too much for your home loan? Examine your re-finance choices with a relied on lending institution. Answer a few inquiries below as well as connect with a lending institution who can help you re-finance as well as conserve today!.

At NerdWallet, we aim to assist you make financial choices with confidence. To do this, lots of or every one of the items included below are from our partners. However, this doesn't influence our assessments. Our point of views are our own. "Home loan" originates from the Latin word mort, suggesting fatality as in "this debt is yours up until you die." Mortgages are more versatile than their root word indicates, yet these legal agreements that cement your obligation to repay your house funding are still go to this website a huge commitment.

A duplicate of your mortgage is submitted in the county records as a lien, or legal insurance claim, against the house. A promissory note is another lending paper you'll authorize, assuring to settle the cash you've borrowed, with passion. It goes together with a home mortgage. The term mortgage can likewise refer to the funding itself.

Cape Coral Mortgage Company Can Be Fun For Anyone

Your payments can cover numerous costs, consisting of: A finance's major balance is the quantity that's delegated repay your initial lending quantity minus payments you've made versus that balance. As an example, if you borrowed $200,000 and settled $24,000 towards that original amount, the staying primary balance is $176,000. With an amortizing home loan, like a 30-year fixed-rate mortgage, a few of each settlement reduces the principal owed and some pays for passion; the complete equilibrium will certainly be paid completely by the end of the lending term.

Your lending institution might gather real estate tax along with your home mortgage repayment as well as keep the cash in an escrow account till your building tax obligation expense is due, paying it in your place during that time (Cape Coral Mortgage Lenders). House owners insurance policy, which can cover damages from fires, tornados, mishaps and also other disasters, generally is called for by home loan loan providers.

When you make a deposit of less than 20% of the purchase rate, lending institutions typically require you to spend for home loan insurance policy. Home loan insurance shields the lender versus the threat that you'll skip on the car loan. There are 2 types: personal home mortgage more info here insurance coverage, or PMI, and also forms of home loan insurance policy needed for government-backed car loans, such as FHA lendings (insured by the Federal Housing Management).

A 2nd home loan is a funding on a residence that has an initially, or primary, mortgage. It, as well, makes use of the home as security - Cape read this post here Coral Mortgage Lenders. If you can not make your home mortgage settlements and also the home is marketed, the bank loan likewise called a jr lien is second in line to be paid off, after the initial mortgage.

Offers for home loans abound online, on buses, benches, signboards, and also wrapped around vehicles. Home mortgage lendings are available from banks, cooperative credit union, nonbank lending institutions, home loan brokers and, on a smaller range, insurance provider. Even relative can supply home loan car loans. To locate the most effective mortgage for you, think about using with at the very least 2 lending institutions, so you can contrast offers - Cape Coral Mortgage Lenders.

Everything about Mortgage Lenders Cape Coral Fl

With each, you'll select a term the lending's time frame as well as pick among interest rates supplied to you by lenders based upon your credit scores rating and also various other criteria. The most-common home loan programs are: Government-backed loans: These consist of FHA fundings, VA lendings, as well as U.S. Division of Farming Rural Development Assured Housing home mortgages.